Public Information Advisory - FY 2027 Council Budget Schedule

OFFICE OF THE CITY CLERK

Richmond City Hall - 900 E. Broad Street, Suite 200 - Richmond, Virginia 23219 U.S.A. - www.rva.gov/office-city-clerk

PUBLIC INFORMATION ADVISORY

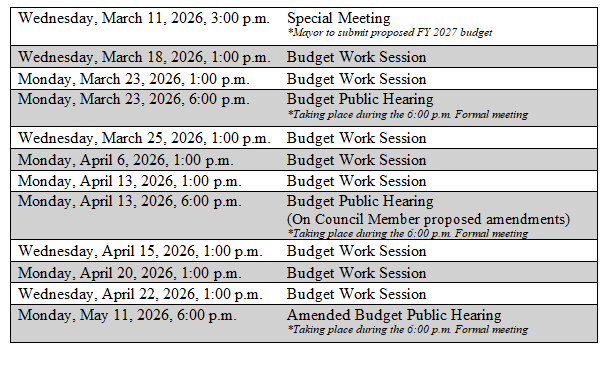

WHAT: Planned Richmond City Council FY 2027 budget-related work sessions, special meeting, and public hearings.

WHEN:

WHERE: Council Chamber

City Hall

900 East Broad Street, 2nd Floor

Richmond, VA 23219

Meeting agendas and related documents will be accessible upon availability on the City’s legislative website.

CONTACT: For more information, please contact Council Chief of Staff RJ Warren at [email protected].