Open Houses Scheduled for FEMA Flood Map Review

FEMA is proposing updates to the Flood Insurance Rate Map (FIRM) for City of Richmond, VA. Newly revised preliminary flood insurance rate maps for Richmond will be available for residents to review at public open houses on Tuesday, August 8 and Wednesday, August 9. A virtual session is also offered on Tuesday, August 15 .

Flooding is the number one natural disaster in the United States; it is vital for property owners to understand their risk and take advantage of the tools and programs available to them, including flood insurance, to help reduce flooding impacts. Flood maps show the extent to which areas are at risk for flooding, and when they become effective, updated maps will be used to help determine flood insurance and building requirements. The open house provides City of Richmond property owners the opportunity to see the preliminary maps, learn about their risk of flooding and hazard mitigation, as well as ask questions about what the new maps will mean for their property.

Significant community review of the maps has already taken place, but before the maps become final, community partners can identify any corrections or questions about the information provided and submit appeals or comments. They are more precise than older maps because better flood hazard and risk data make the maps more accurate. The ultimate goal is protecting property owners and the community from the risks associated with flooding.

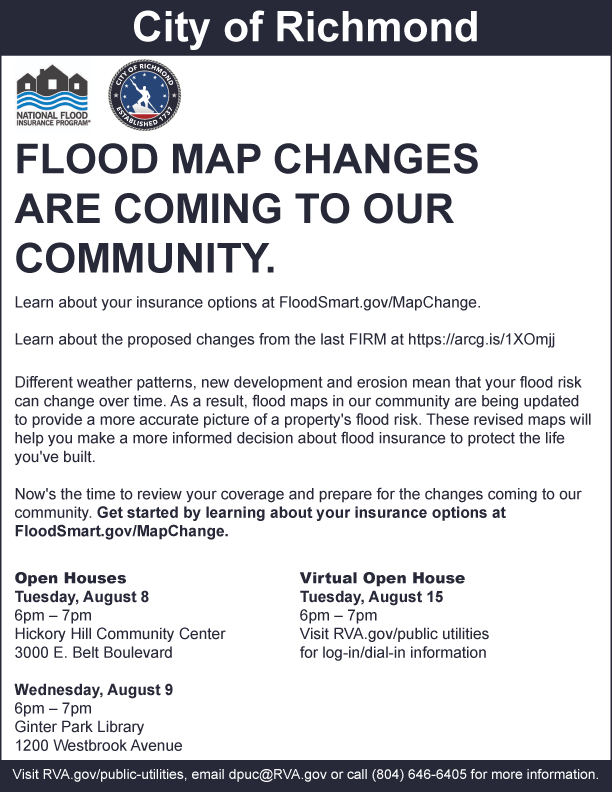

Open House Dates

Tuesday, August 8 Wednesday, August 9

Hickory Hill Community Center Ginter Public Library

3000 E. Belt Boulevard 1200 Westbrook Avenue

6:00 pm – 7:00 pm 6:00 pm – 7:00 pm

Virtual Open House/Town Hall

Tuesday, August 15

6:00 pm – 7:00 pm

Click here to join the meeting or call 1-804-316-9457 and enter passcode 66786930.

As a result of these maps, some buildings in Richmond may, for the first time, be included in a high-risk flood zone, known as the Special Flood Hazard Area (SFHA). This may result in the mandatory purchase of flood insurance for those property owners who are affected.

Over time, flood risks change due to construction and development, environmental changes, floodplains widen or shift, and other factors. Flood maps are updated periodically to reflect these changes. Home and business owners, renters, realtors, mortgage lenders, surveyors and insurance agents are encouraged to attend the open house.

By law, federally regulated or insured mortgage lenders require flood insurance on buildings that are located in areas at high risk of flooding. Standard homeowners’, business owners’, and renters’ insurance policies typically don’t cover flood damage, so flood insurance is an important consideration for everyone. Flood insurance policies can be purchased from any state licensed property and casualty insurance agent. Visit www.floodsmart.gov or call 888-379-9531 for more information about flood insurance and to locate a local agent. There are cost-saving options available for those newly mapped into a high-risk flood zone. The City of Richmond is a participant in the National Flood Insurance Program’s Community Rating System, which provides Richmond residents with a discount on flood insurance.

Submit appeals and comments by contacting your local floodplain administrator Eric Whitehurst [email protected]. The preliminary maps may be viewed online at the FEMA Flood Map Changes Viewer: http://msc.fema.gov/fmcv. Changes from the current maps may be viewed online at the Region 3 Changes Since Last FIRM Viewer FEMA Region 3 Mitigation Mapping and Data

For more information about the flood maps:

- Use a live chat service about flood maps at http://go.usa.gov/r6C (just click on the “Live Chat” icon).

- Contact a FEMA Map Specialist by telephone; toll free, at 1-877-FEMA-MAP (1-877-336-2627) or by email at [email protected].