VRS website: https://www.varetire.org/

RRS website: https://www.rva.gov/

What is Retirement?

Retirement refers to the time of life when one chooses to leave the workforce behind.

The traditional retirement age is 65 in the United States and most other developed countries, many of which have some kind of national pension or benefits system in place to supplement retirees' incomes.

How much to save for retirement depends in part on how long you will expect to live in retirement and how much annual income you will need to live comfortably.

| Term | Definition |

|---|---|

| Actuarially Defined Contribution (ADC) | What the retirement system’s actuaries annually say the city contribution should be to fund future benefit payments (for defined benefit plans). |

|

Defined Benefit (or “DB”) Plan |

A pension plan which provides retirees with a monthly retirement payment based on certain inputs and calculations. |

| Defined Contribution (or “DC”) 401(a) Plan | A retirement plan that contributes money into investment accounts; available for state and local governments. |

| Deferred Compensation 457(b) Plan | Voluntary contributions made by the employee or employer which are invested; available for state and local governments. |

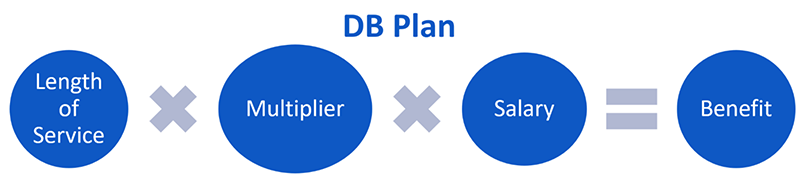

Defined Benefit (DB) plans, or pensions are the foundation of future retirement. Many longstanding institutions, like governments, have historically offered DB plans.

If you have a DB plan, you will receive a monthly retirement payment for the rest of your life starting when you choose to retire.

You contribute a certain percent of your salary to your DB plan. Your employer contributes the ADC that the system’s actuaries say is required every year based on complex calculations.

The retirement system is responsible for managing the investments and the risks of DB plans.

Defined Contribution (DC) plans provide tax-deferred retirement savings.

You may have heard of a 401(k), which is a common type of DC plan offered by private companies. The city offers a 401(a) plan, the local government equivalent DC plan.

If you have a DC plan, your retirement benefit will be based on contributions to the plan over your years of service as well as investment performance. You will have access to the full account balance when you retire. It is up to you what you do with the funds in your account.

When it comes to DC plans, you manage the investments and the risks.

| Defined Benefit (DB) | Defined Contribution (DC) | |

|---|---|---|

| What is it? |

Pays out a monthly benefit |

Account balance based on investment performance |

| How is it funded? |

Employer Contribution (ADC) |

Employer Contribution (Percent of Salary) |

| How is the benefit calculated? | Creditable Compensation x Eligible Years of Service x Compensation Rate Multiplier = Monthly Benefit | Employer/Employee Contribution + Interest = Account Balance (minus fees) |

DB and DC plans are calculated differently.

The monthly benefit of your city DB plan is calculated using your length of service, a multiplier, and your average final compensation.

The benefit of your DC plan is calculated as the percent of your salary contributed by you and the city, plus any interest and investment gains or losses (minus fees).

To learn more about the types of plans you are eligible for, click here.

The city reserves the right to make benefit changes.