Contact Us

Phone

Email

Commercial Real Estate Tax Abatement Program Contact

For more information, or to apply for the Commercial Real Estate Tax Abatement Program, contact:

Carla Childs, Management Analyst, Senior

(804) 646-7438

Commercial Real Estate Tax Abatement Program

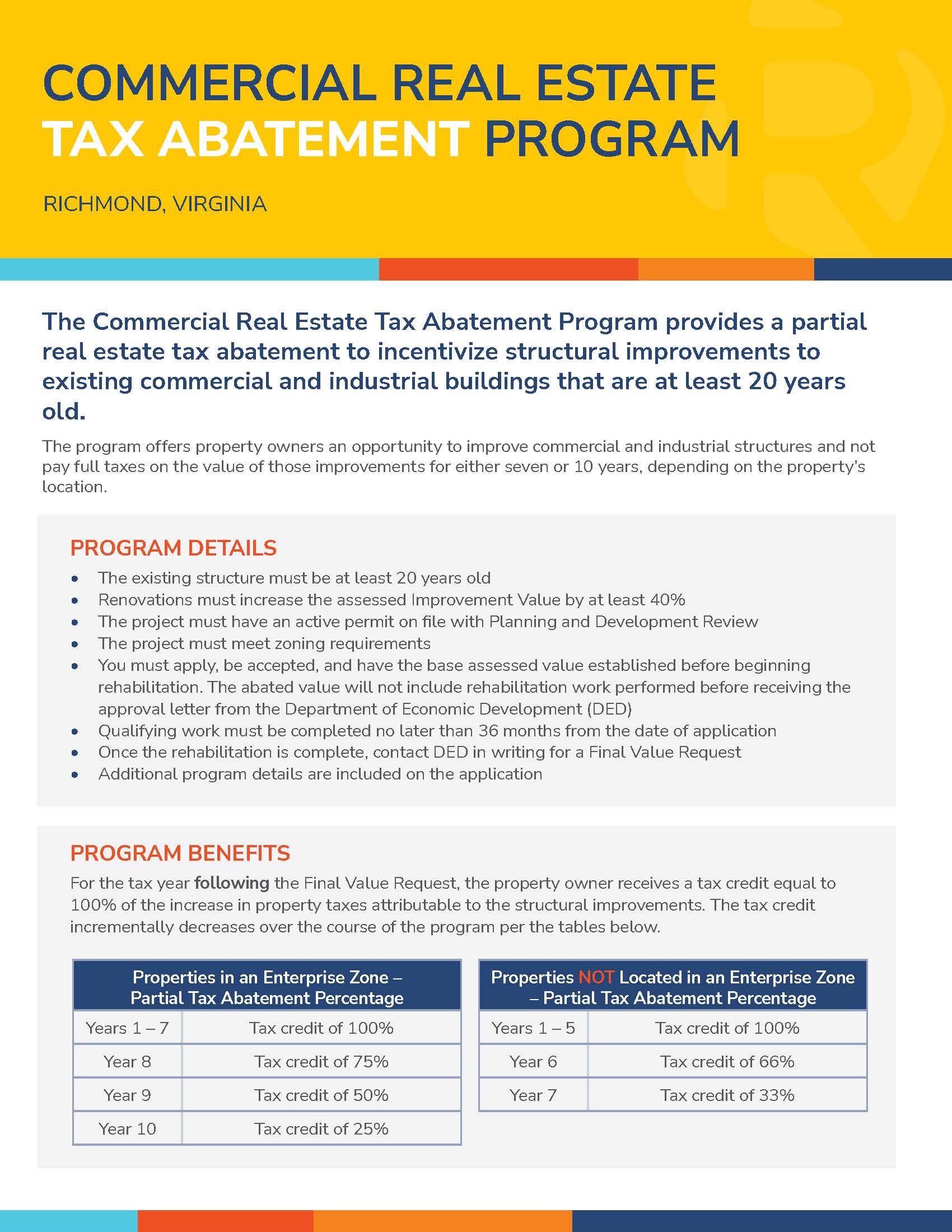

Program Details

- 10-year program

- First 7 years at 100%, then decreases by 25% each year after until it's gone

Qualifications

- Must be in an Enterprise Zone

- The structure must be at least 20 years old

- You must increase the Improvement Value by at least 40%

- You must have an active permit on file with Planning and Development Review (room 511 of City Hall)

- Additions/Replacement

- Structures cannot exceed the total square footage of the qualified structure by more than 100%

- Must meet Zoning Requirements

- Applications in Historic Zones will be forwarded to the Architectural Review Board for review

Applications

- Download the application here. Application is a fillable form and can be filled out online.

- Applications should be mailed/emailed to the DED's office with a $250.00 check or money order and a copy of the building permit

- Must inform DED's office, in writing, when work is complete

- Once qualified, the credit begins January 1 following the receipt of the Final Value Request

- Applications expire 24 months from the date of application